Chinese Solar Sector’s Recovery Unlikely as Glut Persists – Financial Post

Article content

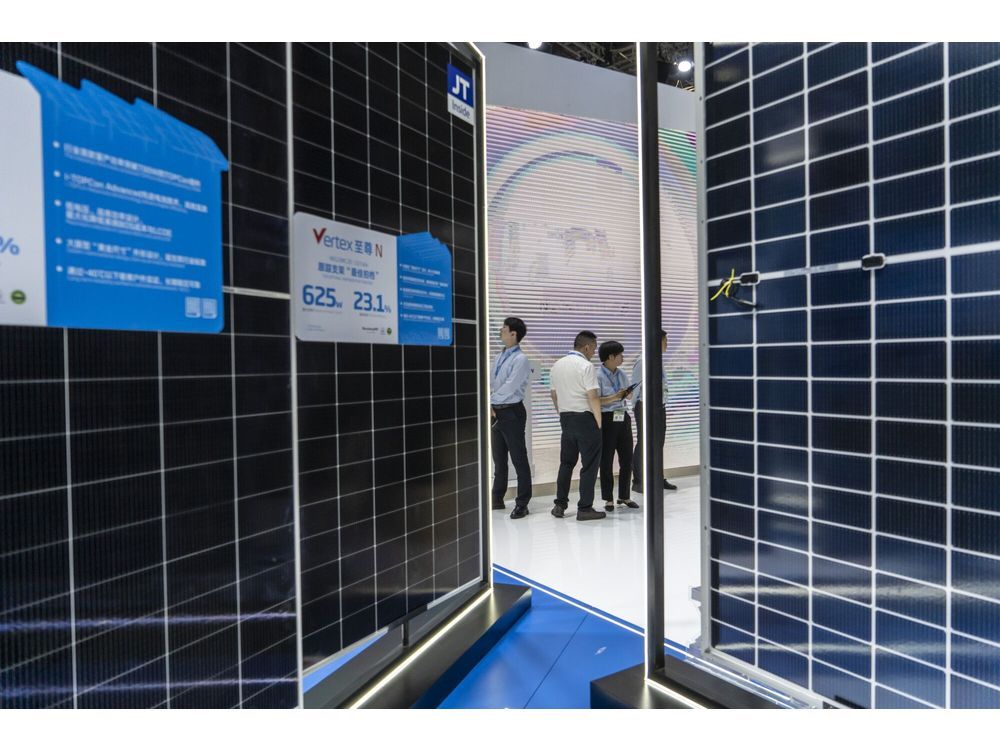

(Bloomberg) — China’s floundering solar sector will continue to face tough times in the short-term, major manufacturer Longi Green Energy Technology Co. said, as an oversupplied market keeps profits suppressed.

The nation’s world-leading solar industry is grappling with a deepening glut after production outstripped demand in recent years. Major firms including Longi reported losses in the first quarter as they were forced to sell below costs.

Article content

“There’s no capacity in the industry to support further price falls in the short-term,” the firm said in a stock filing on Monday. Prices may recover in about three months, but not significantly, it added.

“2024 will be a very tough year for the company and the industry,” it said.

An oversupply of products is unlikely to ease for up to two years, analysts at Citi Rsearch and Daiwa Capital said in separate notes.

The solar manufacturer believes existing products are unlikely to be profitable in the foreseeable future, and is betting on its new technology that it says is more efficient in transforming solar energy into electricity. Longi’s new product is more advanced, but not yet cost-competitive, Citi Research said.

Listen on Zero: Making Solar Panels Is ‘Horrible’ Business. The US Still Wants It.

“We don’t see any catalyst in sight justifying a fundamental recovery for the sector, and suggest investors not place false hope in a solar recovery,” Dennis Ip, an analyst at Daiwa Capital, said in a note on Thursday.

Fierce competition at home had pushed many Chinese solar companies to seek higher premiums overseas, including in the US, despite geopolitical risks. Longi has a joint venture in Pataskala, Ohio that began producing panels earlier this year. The company is also considering building a cell factory in the US and will likely make a decision in three months.

China’s solar products have been subject to tariffs in the US for more than a decade, prompting companies including Longi to set up factories in Southeast Asia. But a recent US government probe into these Southeast Asian plants have led some companies to shut down capacities there, too.

(Recasts with Longi statement and adds context on overseas market in paragraph 8-9)

Share this article in your social network