Australia’s rooftop solar PV market backslides in June, says Sunwiz – PV Tech

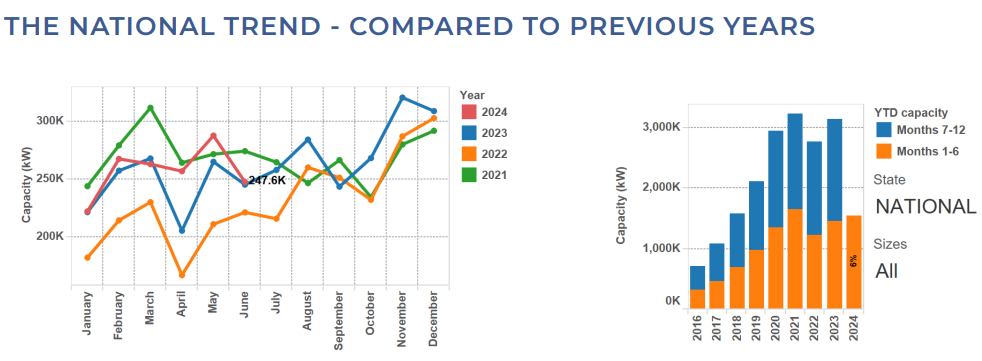

On a positive note, however, the June volume is above the figures seen for the same month in both 2022 and 2023 while below 2021’s figure, which reached around 275MW. A breakdown can be found below.

2023 saw Australia achieve a key milestone by surpassing 20GW of installed rooftop solar PV capacity nationwide, adding 2.9GW throughout the year. According to the Clean Energy Council trade association, the technology has become the country’s second-largest source of renewable electricity generation.

As pictured above, this 20GW milestone was aided by robust registration of rooftop PV volumes, particularly in November, when it surpassed the 300MW range.

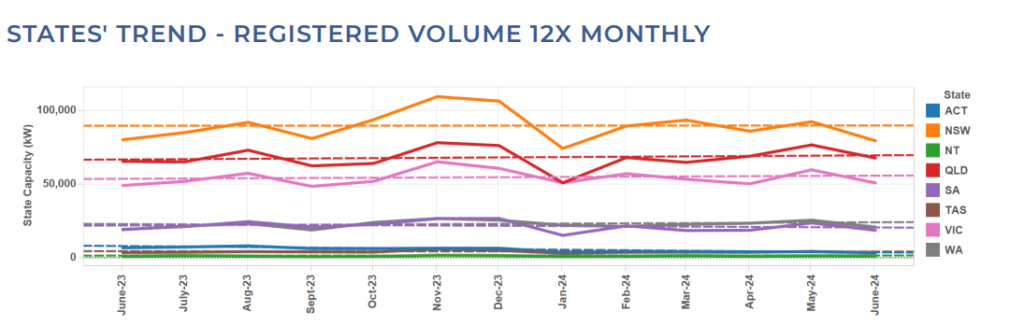

Every state goes backwards but Queensland tops the group

According to Sunwiz’s data, volumes in all states and territories declined month-on-month in June. However, Queensland fared the best out of the large states, with a 12% decline. The Australian Capital Territory and the Northern Territory witnessed a drop of 11% each in volume, whereas New South Wales saw a month-on-month drop of 14%, with Victoria close behind with a 15% drop.

Tasmania, Western Australia, and South Australia all saw higher month-on-month volume reductions than their counterparts, with 22%, 18%, and 21%, respectively.

Queensland is expected to triple its rooftop solar PV capacity as the state looks to develop local renewable energy zones (LREZ). Two LREZ locations, one in Townsville and the other in Caloundra, have been revealed in the last month.

Each LREZ aims to deploy up to 8.4MW/18.8MWh of battery energy storage and support up to an additional 2.8MW of solar PV and 0.9MW of demand management.

Smaller systems fare better than more extensive residential

Another key takeaway from the report is that small systems, specifically those below 6kW, fared better than larger systems in June. Sunwiz stated that sub-3kW and 4-6kW systems also decreased in total volume (-4% and -3%, respectively) but to far lesser extent than 6-8kW and 10-15kW systems (-20% and -15%, respectively).

Most of the commercial market went backwards, but again to a lesser extent than those key residential ranges.

It is worth noting that the average system size continued its upward trend since March 2024, now reaching 9.9kW.